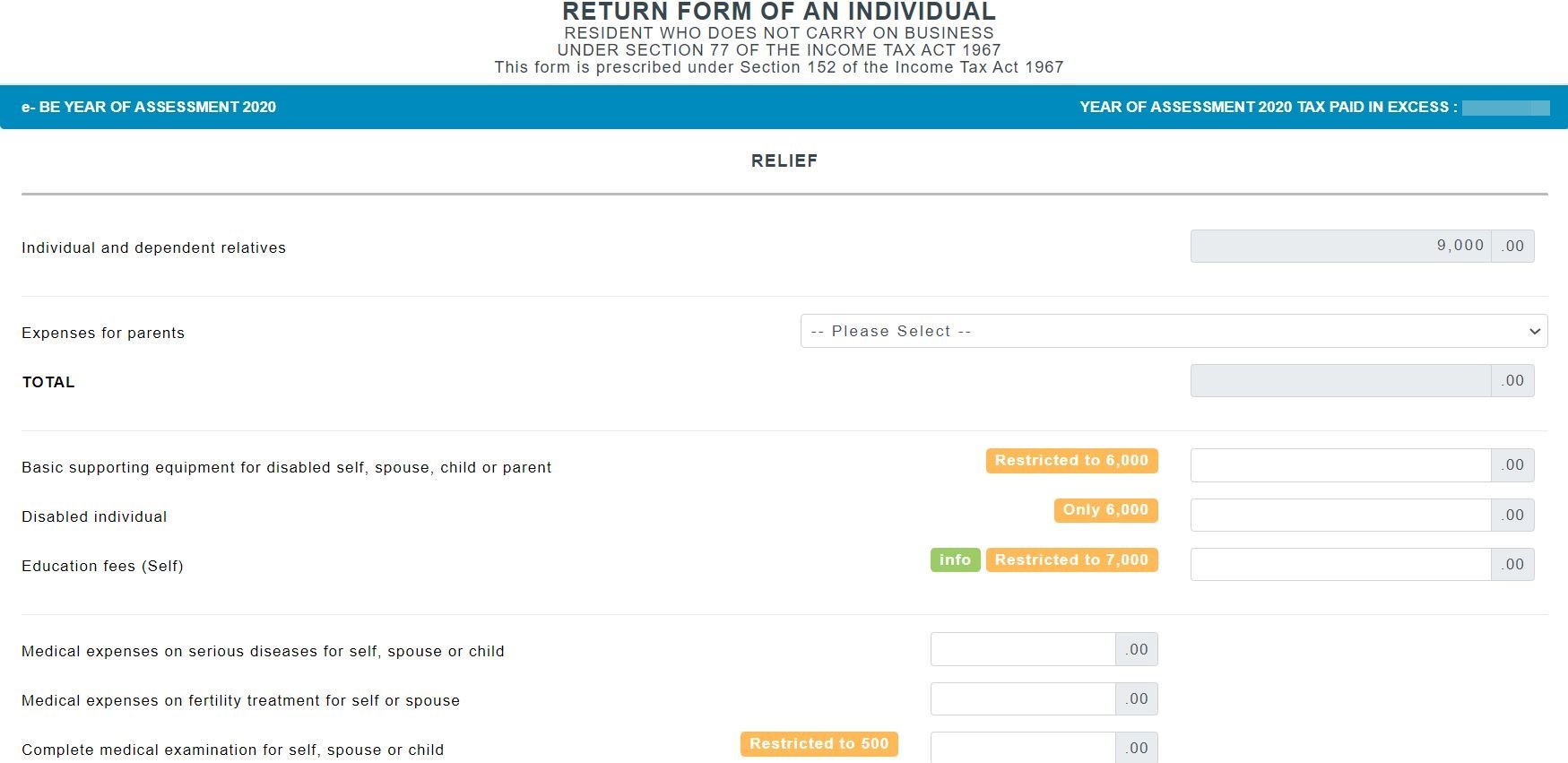

Income tax rate on a resident individual is on a progressive basis where the rate is 0 on chargeable income not exceeding RM 5000 and 30 on chargeable income exceeding RM 2 million. Tax Rate of Company.

Kopiko Sdn Bhd Income Statement For The Year Ended 31 Chegg Com

QUESTION 1 PART i SATI SDN BHD 2019 RM Adjusted income 35000 Less.

. Paid-up capital up to RM25 million or less. If Krunch Sdn Bhd has a paid-up capital of below RM 25 million the company is required to pay out 17 or 24 of the interest income taxable deemed to had received if its chargeable income for 2019 is below RM 500000 and above RM 500000. The rate of the AIE for PBSB will therefore be 10 of the value of increase in export sales in YA 2020 over that of the preceding year YA 2019.

Headquarters of Inland Revenue Board Of Malaysia. The tax rate is 23. Chargeable income equivalent to RM 3000000 RM 3000000 SGD 977005 HKD 5619760 CNY 5074030 Highest tax rate 30 22 17 45 Estimated tax liability RM 900000 SGD 214941 HKD 955359 CNY 2283314 Conversion to RM RM 900000 RM 660000 RM 510000 RM 1350000 Note.

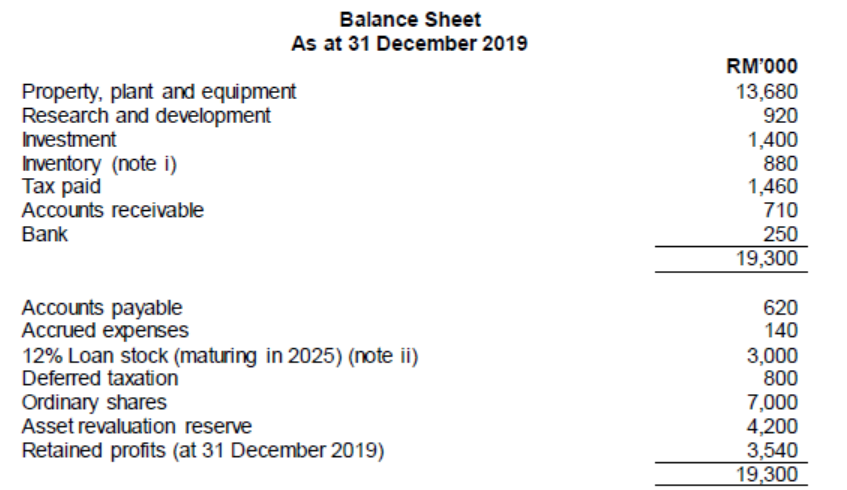

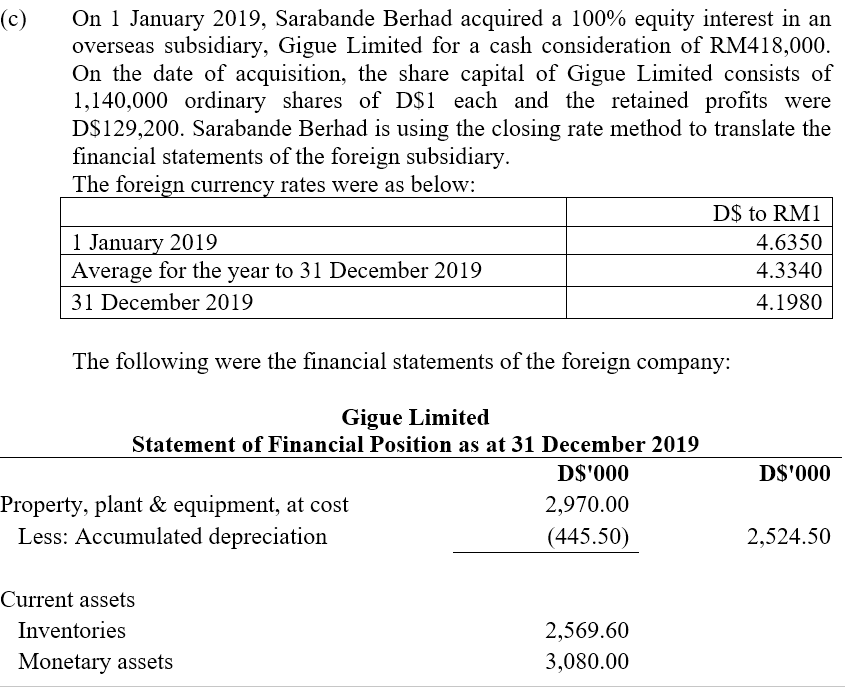

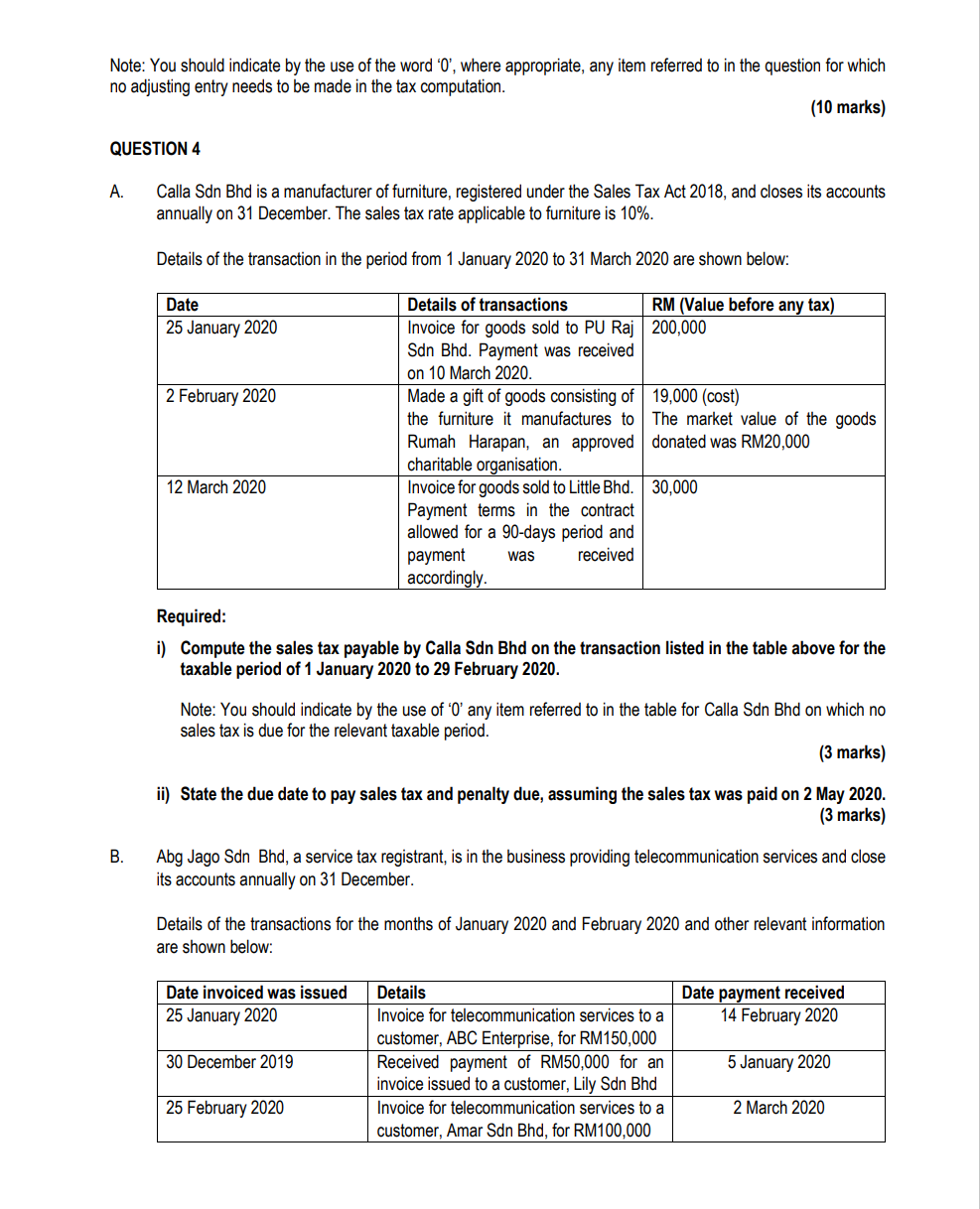

A Rondo Group Berhad makes up its accounts to 31 December each year. Answer Simple Questions About Your Life And We Do The Rest. Filing of Return and Tax Payment SST Registrant.

Sales Service Tax SST Sales tax is a single-stage tax charged on taxable goods manufactured in or imported into Malaysia by a taxable person and is due when the goods are sold disposed of or first used with a total sale value of more than RM500000 in 12 months. The fees paid to B Ltd for the services was RM100000. Calculations RM Rate TaxRM A.

Following table will give you an idea about company tax computation in Malaysia. Discover Helpful Information And Resources On Taxes From AARP. These companies are taxed at a rate of 24 Annually.

Your 2021 Tax Bracket To See Whats Been Adjusted. Rate On the first RM600000 chargeable income. A specific rate of tax of RM25 is imposed upon issuance of principal or.

Supervise the installation and operation of the plant from 1542019 to 3152019. Enterprise less flexible. On the First 5000 Next 15000.

Tax under section 109B of the ITA at the rate of 10. In Order to Get the Most Tax Benefits Janet Media Sdn Bhds Income Should Stay Below the 17 Tax Bracket Here Janet can calculate the amount of salary she could pay herself from JM to obtain the best tax benefit possible. Sdn Bhd Corporate Tax.

On the chargeable income exceeding RM600000. B Installation and commissioning services. There are two revisions available in the sixth month November 2018.

Only subject to the 17 24 corporation tax rate for small middle size company 3. A Sdn Bhd bought a power plant from B Ltd a company resident in India. 75 in Inara Sdn Bhd.

However there is a non. Sole proprietor or partners resident individual is taxed on his chargeable income at graduated rates from 1 to 28 after the deduction of tax relief. This rate is relatively lower than what we have seen in the previous year.

Every 50 preference shares can be converted into 100 ordinary shares in year 2034. Of Krunch Sdn Bhd. On 1 January 2019 the company had in issue 340 million ordinary shares of RM2 each.

On the First 5000. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. Company with paid up capital not more than RM25 million.

The company issued 650000 10 convertible preference shares of RM1 each. 73 in Top Sdn Bhd. RSPs percentage of shareholding in its subsidiaries is as follows.

Small and medium enterprises SMEs pay slightly different company tax as compared to other resident companies. 3 C28 February 2019 Aye Sdn Bhds financial year end is 31 May. YA 2019 Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1 On first RM500000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis period 24 Non-resident company branch 24 Note 1.

You are required to advise RSP Sdn Bhd on tax planning opportunities to reduce tax liabilities for RSP. For YA 2019 the basis period is 1 June 2018 to 31 May 2019 and the due date to submit an initial tax estimate is 30 days before the commencement of the basis period for YA 2019 which is 1 May 2018. The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia.

- 60 in TSV Sdn Bhd. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba. Its forecasted aggregate income is approximately RM1 million per annum from YA 2019 onwards.

Box 10192 50706 Kuala Lumpur Malaysia Tel. 25000002500000 over the YA 2019 export sales. View ADV TAX FINALdocx from ACCOUNTING BAC at International University of Malaya-Wales.

Ad Compare Your 2022 Tax Bracket vs. There are exemptions for certain goods manufactured or imported. 1 Report to PandaiBuat Sdn Bhd From Tax Firm To Mr Bok Chek Wai Chief financial officer PandaiBuat Sdn Bhd.

The State Of The Nation Finding Room To Lighten The Middle Income Tax Burden The Edge Markets

Solved A Rondo Group Berhad Makes Up Its Accounts To 31 Chegg Com

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Public Revenue To Shrink To Rm227 3b In 2020 Amid Lower Tax Collection The Edge Markets

Malaysia Sst Sales And Service Tax A Complete Guide

How To Set Up File And Manage Sales Tax In Quickbooks Online Youtube

Malaysia Personal Income Tax Guide 2021 Ya 2020

Income Tax Malaysia 2018 Mypf My

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Company Tax Rates 2022 Atotaxrates Info

Malaysia Personal Income Tax Guide 2021 Ya 2020

1 Nov 2018 Budgeting Inheritance Tax Finance

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting

Qatar Currency Timeline Exchange Rate All About Qatari Riyal Qatar Currency Qatari

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Section B All Six Questions Are Compulsory And Must Chegg Com