A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Calculating Trust Income Tax.

Everything You Need To Know About Running Payroll In Malaysia

Foreign income mortgage calculator.

. Malaysian professionals returning from abroad to work in Malaysia would be taxed at a rate of 15 for the first five consecutive years following the professionals return to Malaysia under the Returning Expert Programme REP. KUALA LUMPUR 30 Dis The government has agreed to exempt taxation on foreign source income FSI for resident taxpayers to ensure the smooth implementation of the tax initiative said the Ministry of Finance MoF. Late filing or non-filing of Income Tax Returns Form T Paying Estate Trust Income Tax Go to next level.

We assist all clients in managing their. For every RM 1 above will be 7 tax to pay is RM 220. RM 23150 x 28 RM 6482.

Tax chargeable on the rental Income will be. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income. The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2.

Calculating Estate Income Tax. For the most part foreigners working in Malaysia are divided into two categories. For non-resident tax rate chargeable will be.

This will be in effect from 2020. The table below shows fields of foreign income against income tax percentage rate in Malaysia. The following foreign-sourced income which is brought into Malaysia from 1 January 2022 to 31 December 2026 will remain exempt from Malaysian income tax.

Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. Non-residents are taxed a flat rate based on their types of income. Domestic travel travelling within Malaysia expenses have RM100000 tax relief.

Get tax saving worth RM300000 for childcare expenses for children up to 6 years old. Object to Income Tax Bill. Total to tax to pay.

All classes of income under Section 4 of the Income Tax Act 1967 excluding a source of income from a. Foreigners who qualify as tax-residents follow the same tax guidelines progressive tax rate and relief as Malaysians and are required to file income tax under Form B. The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2022.

Get tax saving worth RM300000 for childcare expenses for children up to 6 years old. The tax exemption is effective from Jan 1 2022 to Dec 31 2026. Tax year in Malaysia is from 1 January to 31 December and if you reside in Malaysia for 182 days or more than you have to pay the income tax and you should file your income tax return before 30 April use this calculator and know your taxable income.

Additional rates will be implemented in case of special instances of income such as interest bonus or royalties etc. Tax on foreign-source income remittance November 18 2021 A provision in the Finance Bill would tax foreign-source income received by any Malaysian resident person effective from 1 January 2022. Filing Estate Trust Income Tax Form T Form T.

Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees. For the first RM 20000 tax to pay is RM 475. Income Tax Calculator Malaysia Calculate Personal Income Tax.

The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. For the resident the tax rate will be. The tax would be imposed at a transitional tax rate of 3 based on the gross amount received from 1 January 2022 through 30 June 2022.

Paying Estate Trust Income Tax. Orders on foreign-sourced income have been published in the Malaysian official gazette. Income Tax in Malaysia in 2022.

However non-residing individuals have to pay tax at a flat rate of 30. Filing Estate Trust Income Tax Form T Go to next level. Subject to Inland Revenue Board criteria and guidelines income tax exemption.

RM500000 tax rebates are given to companies to create a safe living space for the employees and to cover the rents of the accommodation. A non-resident individual is taxed at a flat rate of 30 on total taxable income. This is similar to property tax in other countries.

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2021 Ya 2020

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Malaysian Bonus Tax Calculations Mypf My

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Cukai Pendapatan How To File Income Tax In Malaysia

Individual Income Tax In Malaysia For Expatriates

How To Calculate Income Tax In Excel

Malaysia Personal Income Tax Guide 2022 Ya 2021

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysian Tax Issues For Expats Activpayroll

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

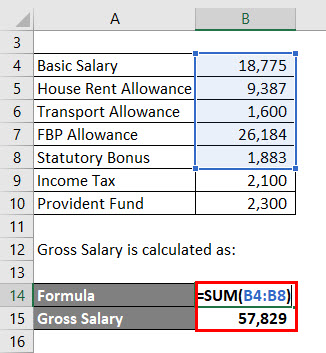

Salary Formula Calculate Salary Calculator Excel Template